Where to Start Saving for Retirement

Retirement is one of the most important financial goals you can plan for because it requires a substantial amount of money to maintain your lifestyle after you stop working. Starting early allows you to take full advantage of compound interest, providing exponential growth to your investments. Despite this, it often gets pushed to the back burner due to more immediate financial concerns. However, retirement should be a top priority, as the longer you wait to start saving, the harder it becomes to build a sufficient nest egg.

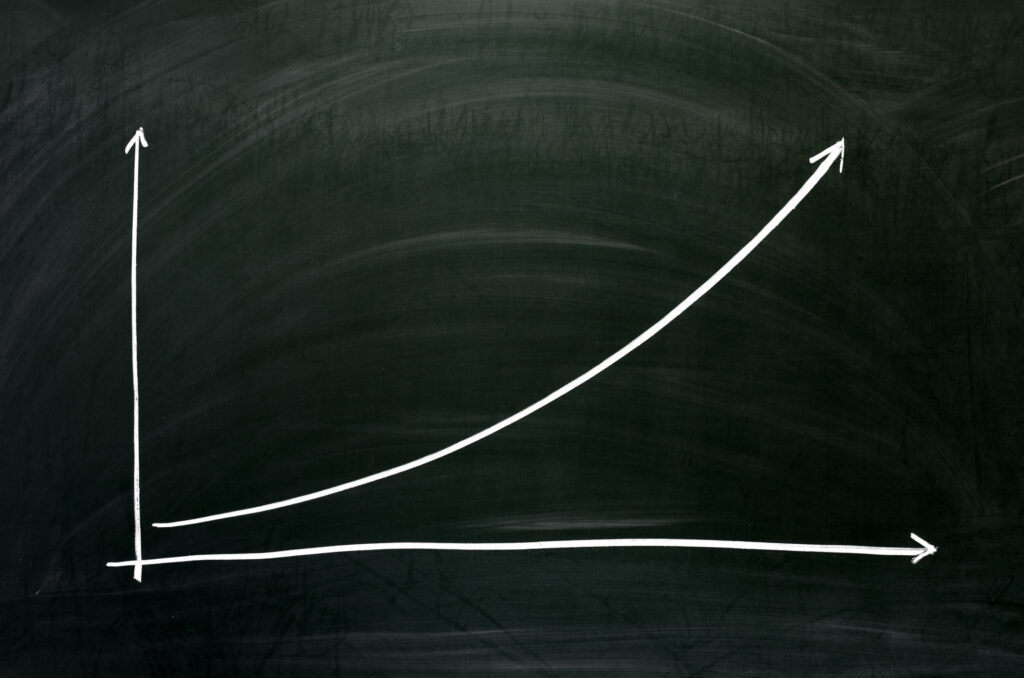

Power of Compound Interest

Compound interest allows your investments to grow faster the earlier you start investing. Overtime, your investments earn interest not only on the initial amount you put in but also on the interest that has already accumulated. Over time, this creates a snowball effect where your money grows exponentially.

To understand how powerful compound interest can be, let’s look at a simple example. Suppose you invest $5,000 a year in a retirement account starting at age 25, earning an average annual return of 7%. By the time you reach 65, you’ll have accumulated approximately $1.14 million. However, if you start saving the same $5,000 per year at age 35, you’ll only have around $566,000 by 65—half the amount, despite saving for only 10 fewer years. Time is the key factor here; the earlier you start, the more time your money has to grow.

Where to Start Saving: Investment Accounts

Now that you understand why starting early is crucial, let’s discuss the best strategy for contributing to retirement accounts. It’s important to note that investment accounts and investment portfolios are two different pieces of the puzzle. Investment portfolios are what you are directly investing your savings into, which allow it to grow over time. Investment accounts are where portfolios are held to provide tax advantages to the growth of portfolios over time. Let’s discuss the order of priority of which investment accounts you should contribute to:

Step 1: Max Out Your Employer Match

The first place to start saving for retirement is in your employer-sponsored retirement plan, typically a 401(k) or 403(b). Many employers offer a company match—essentially free money that you receive if you contribute a portion of your salary to your company plan. They will typically match your contribution up to a certain percentage of your salary. For example, your employer might match 100% of your contributions up to 5% of your salary. If you earn $50,000 per year and contribute 5% ($2,500), your employer will also contribute $2,500 to your retirement account.

Maxing your employer match is always top priority because you are guaranteed 100% return on your investment. It’s hard to beat that kind of return, especially without any additional risk on your part. Failing to contribute enough to get the full match is like leaving free money on the table. Once you’ve contributed enough of your salary to maximize the match, then we move on to the next step.

Step 2: Max Out Contributions to a Roth IRA

Once you’ve secured the employer match, the next step is to invest in a Roth IRA. A Roth IRA offers a unique set of tax advantages that make it an excellent vehicle for long-term retirement savings. Contributions to a Roth IRA are made with after-tax dollars, but withdrawals in retirement are tax-free. Here is small list of the benefits to investing in this account:

- Tax-Free Growth: Since you’ve already paid taxes on the money going into the Roth IRA, your investments grow tax-free. This can be a significant advantage in retirement when tax rates may be higher.

- Flexibility: Roth IRAs allow you to withdraw your contributions (but not your earnings) at any time, without penalties or taxes. This can serve as a useful backup source of funds in case of emergencies.

- No Required Minimum Distributions (RMDs): Unlike traditional 401(k)s or IRAs, Roth IRAs don’t have RMDs, meaning you can let your money continue to grow without being forced to withdraw at age 73.

For 2024, the maximum contribution limit to a Roth IRA is $7,000 per year ($8,000 if you’re age 50 or older). If you are under certain income limits (for 2024, $161,000 for single filers or $240,000 for married couples filing jointly), you should take full advantage of this opportunity to lock in tax-free income for your retirement. If you are over these limits, then you’ll have to complete a couple extra steps in the Backdoor Roth IRA strategy. Once you’ve maxed out your Roth IRA contributions for the year, you can continue to the next step.

Step 3: Max Out Remaining Employer-Sponsored Retirement Plan

After maxing out your employer match and your Roth IRA, the next step is to contribute as much as possible to your employer-sponsored retirement plan up to the maximum contribution limit. Most employer retirement plans are tax deferred, meaning your contributions are tax-free, growth is tax-free, but you’ll pay taxes on distributions when you retire. However, there are some companies who offer after-tax employer retirement plans, that are taxed upfront, but are tax-free while it grows and is distributed. Which type of plan to choose depends on your age, tax bracket, and expected tax bracket in the future. A general rule of thumb is that if you make less than $200,000 a year, contribute to an after-tax account, if possible, but if you’re over $200,000 then contribute to a tax-deferred account.

In 2024, the 401(k) contribution limit is $23,000 per year, with an additional $7,500 catch-up contribution allowed for individuals age 50 and older. Here are some benefits:

- Tax Deferral/After Tax: Any contributions you make to either account will have tax advantages to allow for your retirement savings to grow exponentially.

- Automatic Payroll Deductions: Contributions are typically deducted directly from your paycheck, making it easy to contribute consistently and avoid the temptation to spend the money elsewhere.

- Higher Contribution Limits: While Roth IRAs have a relatively low contribution limit, employer accounts allow you to save significantly more each year, giving you the opportunity to grow a sizable retirement nest egg over time.

If you’ve maxed up to the $23,000 limit and still have extra funds to save for the future, you can use a Super 401k to contribute up to $69,000 to your 401k, or invest the rest in a traditional taxable brokerage account that has no penalties and no tax benefits.

In Summary

Starting early is key to getting to financial independence faster, as it allows you to harness the power of compound interest and maximize your investment growth over time. Prioritize your savings by first maxing your employer match, your Roth IRA, then your employer retirement account to ensure you are getting the most tax advantages on your long-term portfolio growth. If you have any questions or would like personalized advice, feel free to schedule a meeting with our team to discuss your financial planning needs in more detail.

Similar Articles

Retirement Income

Retirement Planning